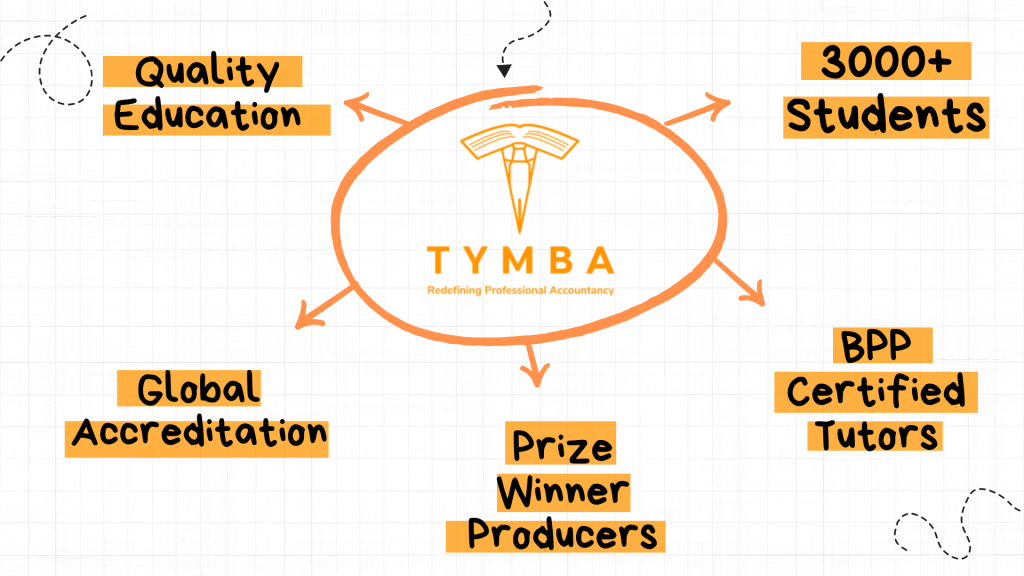

At TYMBA Education, we are committed to shaping the future of professional accountancy by offering world-renowned professional accountancy programs that empower our students to achieve excellence.

Our name, TYMBA—Train Your Mind By A-Team—reflects our dedication to delivering high-quality education through a team of BPP certified tutors who are experts in their fields.

It all begins here at TYMBA.

TYMBA Education Group is a global professional accountancy centre that promotes world-renowned professional accountancy programmes. In less than a year, TYMBA has produced over 3,000 students who have successfully passed their examinations, thanks to our selectively chosen tutors. This achievement has led us to earn global accreditations, including ACCA Approved Learning Partner, ICAEW Partner in Learning, and BPP Tuition Solution Associate Provider. Additionally, TYMBAQueens (Campus Learning) has been awarded ACCA Gold Approved Learning Provider status within just seven months of our first cohort.

Our Journey & Achievements

Our Mission

Our primary mission is to help students pass their exams on their first attempt and to produce more Chartered Accountants who are well-equipped with the skills required in the ever-changing environment of the accounting industry.

At TYMBA, we apply BPP (UK) proven teaching methodology in our courses, personalized to meet the needs of students around the world. This unique learning method, once understood, can be implemented across all ACCA subjects. It is a proven approach that helps students pass their exams and makes learning easier and more effective.

Our Teaching Methodology

Meet our Council of Advisors

National Leaders of the Accounting Industry

The backbone of TYMBA that consistently provide valuable insights and recommendations relating to the accounting industry

Assoc. Prof. Dr. Mahfudzah Mohamed has 31 years of working experience with Faculty of Accountancy, Universiti Teknologi MARA (UiTM). In addition to that, under her leadership, two ACCA Approved Learning Partners have managed to successfully obtain the Platinum status.

Assoc. Prof. Dr. Mahfudzah Mohamed has 31 years of working experience with Faculty of Accountancy, Universiti Teknologi MARA (UiTM). In addition to that, under her leadership, two ACCA Approved Learning Partners have managed to successfully obtain the Platinum status.

Her experience will help TYMBA Education Group to achieve Platinum status within two years and provide guidance to enable TYMBA to be the ASEAN leader in professional accountancy qualifications training.

Dr Nurmazilah is the former Chief Executive Officer of the Malaysian Institute of Accountants (MIA). She holds a PHD in accounting from the University of Birmingham.

Dr Nurmazilah is the former Chief Executive Officer of the Malaysian Institute of Accountants (MIA). She holds a PHD in accounting from the University of Birmingham.

Prior to being appointed CEO of MIA, she had served as a Council member of MIA, a Member of the Malaysian Accounting Standards Board (MASB), an elected member of the Board of Governors for the Institute of Internal Auditors Malaysia (IIA Malaysia), a Council member of The Malaysian Institute of Certified Public Accountants (MICPA) and the Honorary Treasurer with Persatuan Ekonomi Malaysia. Dr Nurmazilah also served in various committees of MIA and MICPA.

Dr Nurmazilah’s role as the proponent of the Environmental, Social and Governance (ESG) programme at TYMBA is aimed to enlighten our students further on the significance of ESG.

ESG is also used as a screening tool at TYMBA for the undertaking of potential investments to assure environmentally and socially conscious investors and protect the interest of all stakeholders.

He is a senior-year accounting student of Universiti Sultan Zainal Abidin and an accounting influencer with keen dedication and experience of tutoring more than 1,500 SPM level students. He has written two accounting books for Form 4 & 5 secondary school students with over 13,000 copies of both books sold.

He is a senior-year accounting student of Universiti Sultan Zainal Abidin and an accounting influencer with keen dedication and experience of tutoring more than 1,500 SPM level students. He has written two accounting books for Form 4 & 5 secondary school students with over 13,000 copies of both books sold.

His vast network and experience, in particular with secondary school students, will act as a touchstone for him to provide valuable insights pertaining to accounting studies and related career opportunities to aspiring secondary school students – hence, enabling them to undertake better and informed decisions in shaping their study and career paths.

Azura, also known as “Umi,” is an experienced and result-driven leader with over 25 years of experience in establishing entities, driving transformation and executing innovative approaches. Serving as a corporate leader to a nation builder and next, to a social entrepreneur as she decided to venture into social entrepreneurship being the Co-Founder of AKRAB Resources in 2021, pursuing her passion to continuously give back and contribute to the people, the community, and the nation.

She has held key roles as the founding Chief Executive Officer (CEO) of Yayasan Peneraju Pendidikan Bumiputera (YP), Chief Internal Auditor & Executive Vice President of Human Capital at Malaysia Airlines and Senior Vice President of Strategic Human Capital Management at Khazanah Nasional Berhad. As the former CEO of YP, she focused on supporting Bumiputera talent through quality education and training programs benefiting more than 25,000 beneficiaries.

Azura is a multifaceted individual who plays pivotal roles across formal and non-formal settings. As a board member, advisor, consultant, and mentor, she brings a wealth of experience and expertise to various organizations. Her diverse skills as a leader, trainer, speaker, counsellor, coach, and singing motivator underscore her versatility and ability to engage and inspire others through training programmes and motivational sessions.

Since 2022, Azura via AKRAB Resources, the learning partner to Yayasan Sime Darby (YSD) leads the role in managing the nurture, development, and growth programmes of YSD scholars under the Bursary, Skill Enrichment, and Special Needs Scholarships. Her other involvement includes conducting talks and training sessions for non-profit organizations, foundations, schools, universities, government agencies and corporate entities as she continues to champion initiatives that empower individuals and contribute to national development, leaving a lasting legacy in education and community empowerment.

A bit of introduction about Tuan Haji Ibrahim, he is the director at Pilihan Wibawa Sdn Bhd (PWSB), focusing on Talent Development, particularly in producing Chartered Accountants (CA). PWSB has strategic partnerships with Flemmings Chartered Accountants in the UK and Pitcher Partners in Melbourne, Australia. Tuan Haji Ibrahim retired from PETRONAS in 2009 after serving 28 years in the HR and Education Division. During his tenure, he supervised thousands of PETRONAS-sponsored students and championed the Professional Accountant Programme, which produced approximately 400 Chartered Accountants. In addition to his role at PWSB, Tuan Haji Ibrahim assists Khazanah Nasional Berhad and Johor Corporation Berhad in producing Chartered Accountants. He also advises Yayasan Khazanah, Yayasan UEM and Majlis Agama Islam dan Adat Melayu Kelantan (MAIK) on Education Sponsorship Management.